39 irs mileage rate 2022

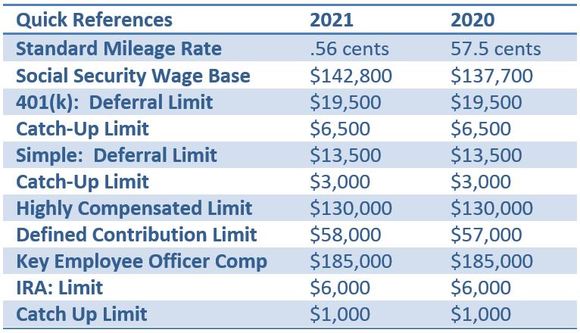

› web › 2022IRS Announces 2022 Mileage Rates | Church Law & Tax The Internal Revenue Service (IRS) has announced the new standard mileage rates for 2022. As of January 1, 2022, the standard mileage rates for the use of a car, van, pickup, or panel truck is: 58.5 cents per mile driven for business use, up 2.5 cents from the 2021 rate. 18 cents per mile driven for medical or moving purposes, up 2 cents from ... › en-us › moneyIRS Announces 2022 Mileage Reimbursement Rate Dec 17, 2021 · 2022 IRS Mileage Reimbursement Rate. Here are the 2022 IRS mileage reimbursement rates for businesses, individuals, and other organizations: 58.5 cents per mile driven for business use. This is an ...

› 2022-irs-mileage-rate2022 IRS Mileage Rate: What Businesses Need to Know Oct 19, 2021 · 1. The Price of Gas. While there are more expenses to driving than just fuel costs, they still play a significant role in calculating the 2022 IRS mileage rate. Fuel can make up as much as 23% of driving costs, and while most of the components of gas prices are typically stable, crude oil prices change daily and are the main influencer of ...

Irs mileage rate 2022

› irs-mileage-rates-2022-5213711IRS Announces Standard Mileage Rates for 2022 Dec 17, 2021 · The Internal Revenue Service (IRS) just released standard mileage rates that taxpayers must use when filing 2022 income taxes in 2023 if they are claiming a mileage deduction for a vehicle they ... › newsroom › irs-issues-standard-mileageIRS issues standard mileage rates for 2022 | Internal Revenue ... Dec 17, 2021 · Beginning on January 1, 2022, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021, 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for ... › tax-professionals › standard-mileage-ratesStandard Mileage Rates | Internal Revenue Service Standard Mileage Rates. The following table summarizes the optional standard mileage rates for employees, self-employed individuals, or other taxpayers to use in computing the deductible costs of operating an automobile for business, charitable, medical, or moving expense purposes. Period. Rates in cents per mile. Source.

Irs mileage rate 2022. › ResourcesAndTools › hr-topicsIRS Raises Standard Mileage Rate for 2022 Dec 21, 2021 · The standard mileage rate that businesses use to pay tax-free reimbursements to employees who drive their own cars for business will be 58.5 cents per mile in 2022, up 2.5 cents from 2021, the IRS ... › tax-professionals › standard-mileage-ratesStandard Mileage Rates | Internal Revenue Service Standard Mileage Rates. The following table summarizes the optional standard mileage rates for employees, self-employed individuals, or other taxpayers to use in computing the deductible costs of operating an automobile for business, charitable, medical, or moving expense purposes. Period. Rates in cents per mile. Source. › newsroom › irs-issues-standard-mileageIRS issues standard mileage rates for 2022 | Internal Revenue ... Dec 17, 2021 · Beginning on January 1, 2022, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021, 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for ... › irs-mileage-rates-2022-5213711IRS Announces Standard Mileage Rates for 2022 Dec 17, 2021 · The Internal Revenue Service (IRS) just released standard mileage rates that taxpayers must use when filing 2022 income taxes in 2023 if they are claiming a mileage deduction for a vehicle they ...

.png)

0 Response to "39 irs mileage rate 2022"

Post a Comment